income tax withholding assistant for employers 2019

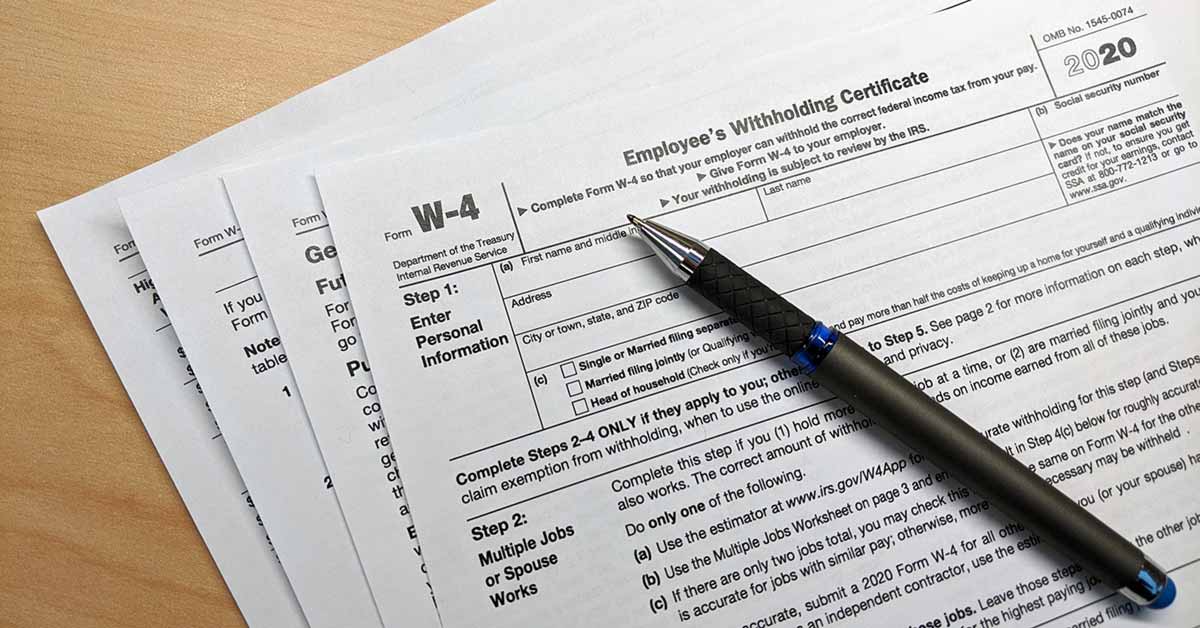

Income Tax Withholding Assistant For Employers This Assistant implements the 2020 IRS Publication 15-T Federal Income Tax Withholding Methods. According to the IRS the new form has been simplified while increasing the transparency of the withholding system.

2019 City Income Tax Withholding MonthlyQuarterly Return.

. This Assistant implements the 2020 IRS Publication 15-T Federal Income Tax Withholding Methods. Claimed to be exempt from withholding. The most common example for state employees is the imputed value of life insurance in amounts above 50000.

The IRS said it would not grant a compliance grace period for implementing the new W-4 so the calculator may help employers that do not have. Employment Training Tax ETT The 2019 ETT rate is 01 percent 001 on the first 7000 of each employees wages. Open the Tax Withholding Assistant and follow these steps to calculate your employees tax withholding for 2020.

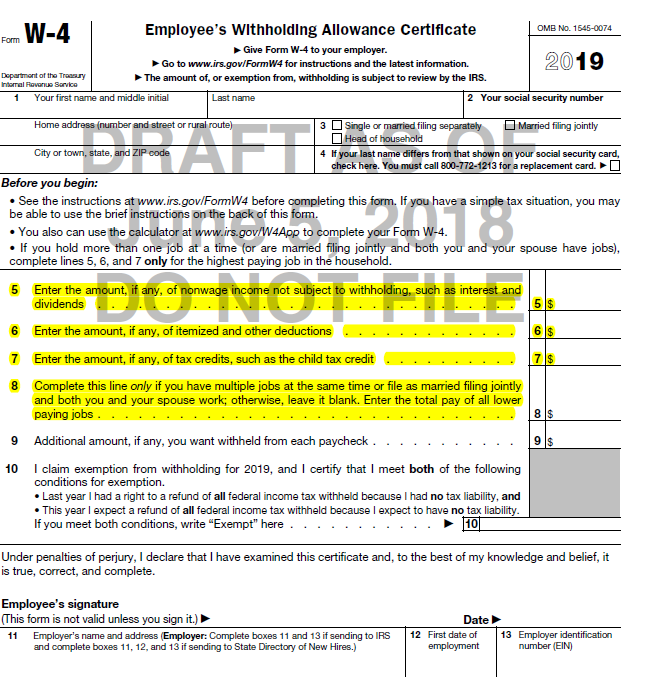

For 2019 the withholding allowance amounts by pay period are to be. Income Tax Withholding Assistant For Employers For use with both 2022 and earlier Forms W-4 This Assistant implements the 2022 IRS Publication 15-T Federal Income Tax Withholding Methods. If you convert a nonresident alien employees 2019 or earlier Form W-4 to a 2020 or later Form W-4 be sure to use Table 2 when adding an amount to their wages for figuring federal income tax withholding.

Employers experiencing a slowdown in business or services because of COVID-19 can apply for the UI Work Sharing Program which. See MRS Rule 104 at wwwmaine. The Income Tax Withholding Assistant which may be downloaded from the IRS website may be used to calculate withholding using the 2020 Form W-4 Employees Withholding Certificate as well as forms W-4 issued that were issued in.

You may also use the Income Tax Withholding Assistant for Employers at IRSgovITWA to help you figure federal income tax withholding. The SDI taxable wage limit is 118371 per employee per year. Employers also may use a new online application the Income Tax Withholding Assistant to help calculate withholding using the 2020 Form W-4 as well as W-4s that were issued in 2019 and earlier.

There are some types of pay both cash and non-cash that must be reported as taxable wages but are not subject to withholding. Its a self-service tool you can use to complete or adjust your Form W-4 or W-4P to help you figure out the right federal income tax to have withheld from your paycheck. Subsequent changes in the law or regulations judicial decisions Tax Appeals Tribunal decisions or changes in Department policies could affect the validity of the information.

The 2019 DIPFL maximum weekly benefit amount is 1252. 2019 Sales Use and Withholding MonthlyQuarterly and Amended MonthlyQuarterly Worksheet. Reduced work hours and available tax assistance for employers.

Enter the three items requested in the upper left corner then fill in the relevant information from the employees Form W-4. The amount of Federal income tax to withhold from this paycheck is provided in the upper right corner. Employees must now file.

Be sure that your employee has given you a completed Form W-4. Use the Income Tax Withholding Assistant if you typically use Publication. Income tax memos - 2019 TSB-M A TSB-M is an informational statement of changes to the law regulations or Department policies.

2019 Sales Use and Withholding Payment Voucher. It is accurate on the date issued. The Assistant can accommodate both the 2020 Form W-4 and Forms W-4 from prior years.

Known as the Income Tax Withholding Assistant for Employers this new spreadsheet-based. The Income Tax Withholding Assistant is a spreadsheet that will help small employers calculate the amount of federal income tax to withhold from their employees wages. For federal income tax withholding only.

This results in weekly withholdings of 118 per year. California Personal Income Tax PIT Withholding. 2019 Sales Use and Withholding 4 and 6 MonthlyQuarterly and Amended MonthlyQuarterly Worksheet.

State Disability Insurance SDI The 2019 SDI withholding rate is 10 percent 01. With the 2020 W-4 only 98 is withheld per paycheck. Use tab to go to the next focusable element.

Enter the three items requested in the upper left corner then fill in the relevant information from the employees Form W-4. If you have a salary an hourly job or collect a pension the Tax Withholding Estimator is for you. It will help you as you transition to the new Form W-4 for 2020 and later.

Federal Income Tax Withholding from Payments That Are Not Wages. This is a new online assistant to help small businesses calculate income tax withholdings with greater ease. If the 2019 W-4 had been used it is likely they would have completed the W-4 as married with two allowances.

If used a 2019 or earlier version This Assistant implements the 2020 IRS Publication 15-T Federal Income Tax Withholding Methods. 26 in Notice 2018-92. This Assistant implements the 2020 IRS Publication 15-T Federal Income Tax Withholding Methods.

You will want to save a separate copy of the spreadsheet for each employee. The rate includes Disability Insurance DI and Paid Family Leave PFL. The amount of Federal income tax to withhold from this paycheck is provided in the upper right corner.

Enter the three items requested in the upper left corner then fill in the relevant information from the employees Form W-4. Income Tax Withholding Assistant for Employers. Enter the three items requested in the upper left corner then fill in the relevant information from the employees Form W-4.

With that in mind the Internal Revenue Service IRS has launched the Income Tax Withholding Assistant for Employers. The amount of Federal income tax to withhold from this paycheck is provided in the upper right. A tool to help employers calculate federal income tax withholding in 2020 was released Dec.

The 2019 SDI withholding rate is 10 percent 01. Since the 2020 version of Form W-4 requires employers to make different withholding calculations than were made with past versions of the form the IRS recently announced that it has created an Excel file that contains an income tax withholding assistant for employers. The rate includes Disability Insurance DI and Paid Family Leave PFL.

Enter the three items requested in the upper left corner then fill in the relevant information from the employees Form W-4. Complete if your company is making required withholding payments on behalf of your companys employees on a monthly or quarterly basis and are making the payments manually by paper check. Withholding allowances still are to be used in 2019 for the federal withholding methods and the Form W-4 Employees Withholding Allowance Certificate the IRS said Nov.

The amount of Federal income tax to withhold from this paycheck is provided in the upper right corner. All employers and non-wage payers registered for Maine income tax withholding accounts must electronically fi le Maine quarterly withholding tax returns and annual reconciliation of Maine income tax withholding. The SDI taxable wage limit is 118371 per employee per year.

Employees Withholding Exemption Certificate and Instructions. IR-2019-209 December 17 2019. The worksheet is geared toward smaller employers and it is available from the IRS.

An employee can have up to 50000 of life. 19 by the Internal Revenue Service. WASHINGTON The Internal Revenue Service has launched a new online assistant designed to help employers especially small businesses easily determine the right amount of federal income tax to withhold from their workers pay.

Employer Resources The Coronavirus 2019 and Coronavirus 2019 FAQs provides. Waivers from this requirement are available if the requirement causes undue hardship.

Is There A Wage Minimum Limit Before Federal Tax Is Withheld My W 2 Shows No Federal Tax Withheld On My Line 1 Wages Of 4657 89

2019 Withholding Is Changing And It S Going To Be A Bumpy Ride

Paycheck Calculator Take Home Pay Calculator

Online Tax Withholding Calculator 2021

How To Calculate Federal Income Tax

Tax Formula Tax Tax Deductions Income Tax

Employer Withholding Department Of Taxation

How To Calculate Federal Income Tax

How To Calculate Federal Income Tax

Paycheck Calculator Take Home Pay Calculator

Instagram S Use Of Third Party Fact Checkers Goes Global Instagram Direct Message Online Business Marketing Facts

Back Office Tax Tools Tax Set Up 2020 Tax Set Up Tabs Support Center

How To Calculate Federal Income Tax

Online Tax Withholding Calculator 2021

Irs Releases Tax Withholding Assistant For Employers Erp Software Blog

How To Calculate Federal Income Tax

Frequently Asked Questions About Form W 4 And Employee Tax Withholding Mypay Solutions Thomson Reuters